The Transformative Effects Of Vitamin C Serum On the Face

Vitamin C serum has emerged as a skincare superstar, celebrated for its multifaceted benefits in promoting a healthier, more radiant complexion. This potent antioxidant, also known as ascorbic acid,…

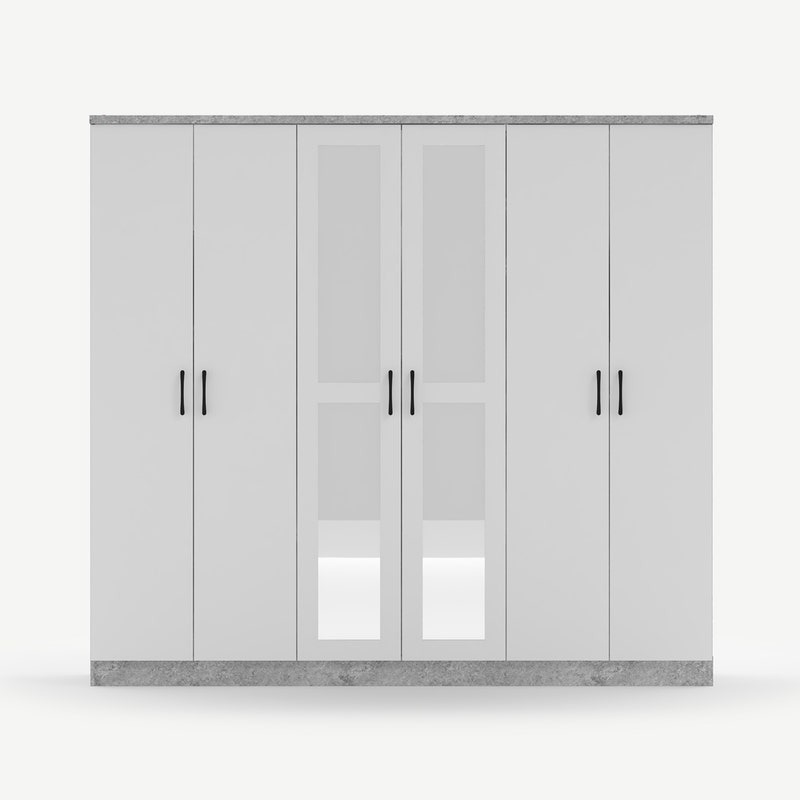

The Beauty Of Door Wardrobes: A Stylish Storage Solution

Door wardrobes stand as a testimony to the perfect fusion of functionality and aesthetics in the realm of home decor. These stylish storage solutions serve as a practical means…

7 Ways To Use Facebook For Marketing

Facebook, with its massive user base and versatile features, remains a cornerstone for digital marketing strategies. Using this platform effectively can significantly enhance brand visibility, engagement, and conversion. To…

The Benefits Of Consuming Peanut Butter

Peanut butter is a beloved food around the world, loved for its creamy texture and delicious flavor. It is made from ground roasted peanuts and can be enjoyed in…

Here’s How You Should Find Reliable Online Boutiques

Are you tired of scrolling through endless pages on fast fashion websites, only to find low-quality clothing that doesn’t fit your style? Look no further! Online boutiques offer a…

The Vital Role Of Forklift Operators

Within the fabric of industrial operations, forklift operators serve as linchpins, orchestrating the movement of materials with precision and expertise. Their role extends beyond simply driving and lifting; it…

Zoho Books vs. Traditional Accounting: A Comparative Analysis

As businesses continue to grow, it becomes necessary for them to keep track of their financial transactions and plan ahead for the future. This is where accounting comes into…

Step Into Luxury And Create Your Dream Walk-In Closet

A walk-in closet is more than a storage space; it’s a private sanctuary that reflects your style, organization, and a touch of luxury. Crafting your dream walk in closet…

The Best Smartwatches For Swimming

Swimming is an excellent full-body workout that provides cardiovascular benefits, builds endurance, and is gentle on the joints. To track your progress and make the most of your time…

Marketing Research Strategies For UAE Business Success

In the fast-paced and competitive business landscape of the United Arab Emirates (UAE), conducting effective marketing research is essential for success. Understanding the local market, consumer behaviors, and emerging…